As of Year 0, the first year of our projections, our hypothetical company has the following financials. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for how to calculate the payback period teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Using the contribution margin formulas – example

These costs may be higher because technology is often more expensive when it is new than it will be in the future, when it is easier and more cost effective to produce and also more accessible. The same will likely happen over time with the cost of creating and using driverless transportation. The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs. For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage. The concept of this equation relies on the difference between fixed and variable costs.

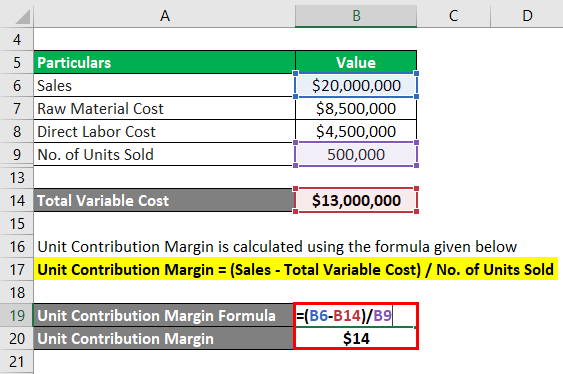

Contribution Margin Formula

To calculate the gross profit, subtract the cost of goods sold (COGS) from revenue. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. At a contribution margin ratio of \(80\%\), approximately \(\$0.80\) of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit.

Similar Accounting Skills

You need to fill in the following inputs to calculate the contribution margin using this calculator. As you can see, the contribution margin per-unit remains the same. Accordingly, the per-unit cost of manufacturing a single packet of bread consisting of 10 pieces each would be as follows. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs.

Formula For Contribution Margin

The key is to focus on the relevant range of activity levels where cost behavior remains relatively stable and predictable. By doing so, executives and managers can make educated decisions that drive profitability and sustainable growth. Use contribution margin alongside gross profit margin, your balance sheet, and other financial metrics and analyses. This is the only real way to determine whether your company is profitable in the short and long term and if you need to make widespread changes to your profit models. Say, your business manufactures 100 units of umbrellas incurring a total variable cost of $500.

- In our example, if the students sold \(100\) shirts, assuming an individual variable cost per shirt of \(\$10\), the total variable costs would be \(\$1,000\) (\(100 × \$10\)).

- Thus, Dobson Books Company suffered a loss of $30,000 during the previous year.

- Investors examine contribution margins to determine if a company is using its revenue effectively.

- On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances.

Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. Let’s now apply these behaviors to the concept of contribution margin. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit. Let’s begin by examining contribution margin on a per unit basis.

The first pitfall that can trip up even the most diligent of us is confusing fixed costs with variable costs. His bagel ingredients were variable costs because they changed based on how many bagels he sold. His rent, on the other hand, stayed the same no matter how many bagels he baked, making it a fixed cost. Contribution margin analysis can help Bob make important business decisions. For example, maybe Bob is thinking about introducing a new type of bagel.

This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit. In these examples, the contribution margin per unit was calculated in dollars per unit, but another way to calculate contribution margin is as a ratio (percentage).