By calculating manufacturing costs, companies can clearly understand the true cost of making a product. Based on this information, the company’s management can add a markup to determine competitive selling prices for their products. Indirect manufacturing irs announces e 2020 costs include all other expenses incurred in manufacturing a product except direct expenses. Direct costs – those that can be traced directly to a particular object of costing such as a particular product, department, or branch.

Smart Ways for Monthly Expense Tracking

The company engaged a consulting firm to help them find out what factors were driving up manufacturing costs. By looking at the historic data on employee timesheets and purchasing costs, the firm was able to understand the areas that were increasing the total manufacturing costs. Direct labor costs include the wages and benefits paid to employees directly involved in the production process of goods or products.

Definition of Nonmanufacturing Overhead Costs

For instance, Ford Motor Company has reduced the price of F-150 Lightning, its electric car, by $10,000. The company has been able to do so by consistently working on improving the efficiency of production and lowering manufacturing costs. For that purpose, the company used sensors to collect and analyze the cost of materials in real time to see how to optimize the costs. Manufacturing and non-manufacturing costs together form total costs for a manufacturing entity.

Nonmanufacturing Overhead (Explanation Part

Table 1.2 provides several examples of manufacturing costs at Custom Furniture Company by category. Fluctuation of costs is yet another challenge that makes it harder to calculate manufacturing costs accurately, according to Fabrizi. Next, calculate the value of the existing inventory if the manufacturing company already has a stock of materials from a previous period. When you add up all these direct costs, you get the Cost Of Goods Sold (COGS), a term used in accounting when preparing the company’s financial statement. From the table you can see that direct materials are the integral part and a significant portion of finished goods. Direct materials – cost of items that form an integral part of the finished product.

Nonmanufacturing Overhead Outline

Whether you’re just starting your own manufacturing business or are looking to venture into the field of cost accounting, understanding manufacturing costs and knowing how to accurately calculate them is crucial for success. A manufacturing entity incurs a plethora of costs while running its business. While manufacturing or production costs are the core costs for a manufacturing entity, the other costs are also just as important as they too affect overall profitability.

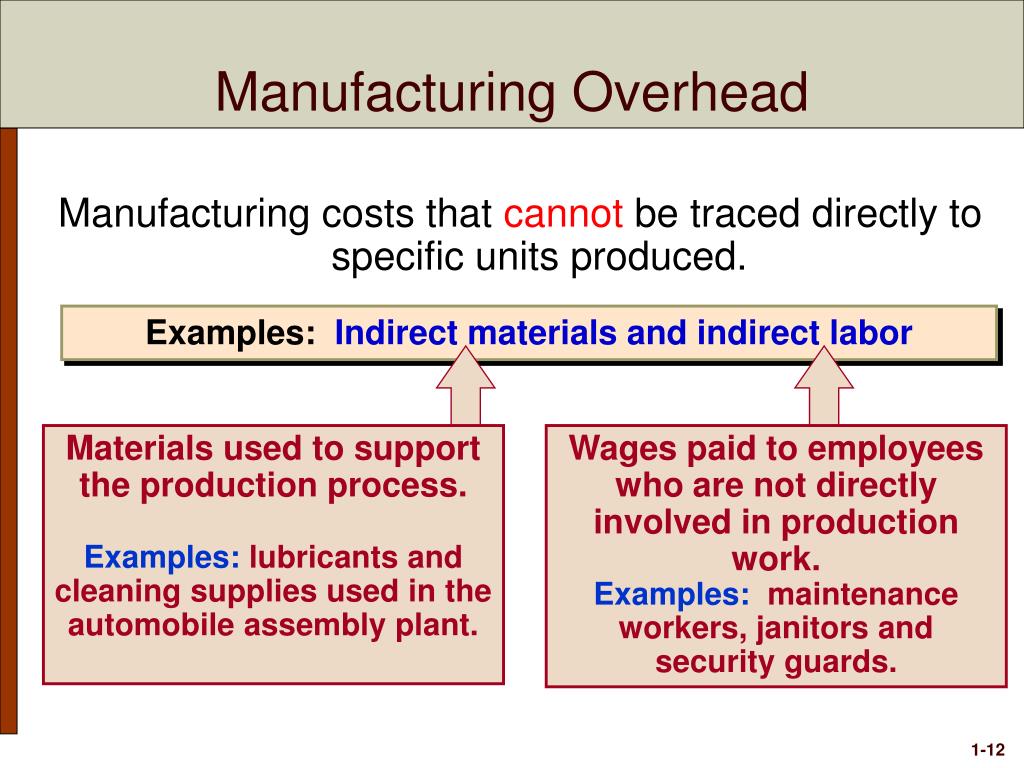

Though most of these costs are self-evident, indirect material costs are unique because these costs are not essential to the physical production of the product. Factory overhead – also called manufacturing overhead, refers to all costs other than direct materials and direct labor spent in the production of finished goods. These costs are reported on a company’s income statement below the cost of goods sold, and are usually charged to expense as incurred.

What about the office rent for the vice president of manufacturing? Therefore, businesses typically establish and adhere to their own criteria. Variable costs – vary in total in proportion to changes in activity. Examples include direct materials, direct labor, and sales commission based on sales. Period costs – are not inventoriable and are charged against revenue immediately. Period costs include non-manufacturing costs, i.e. selling expenses and administrative expenses.

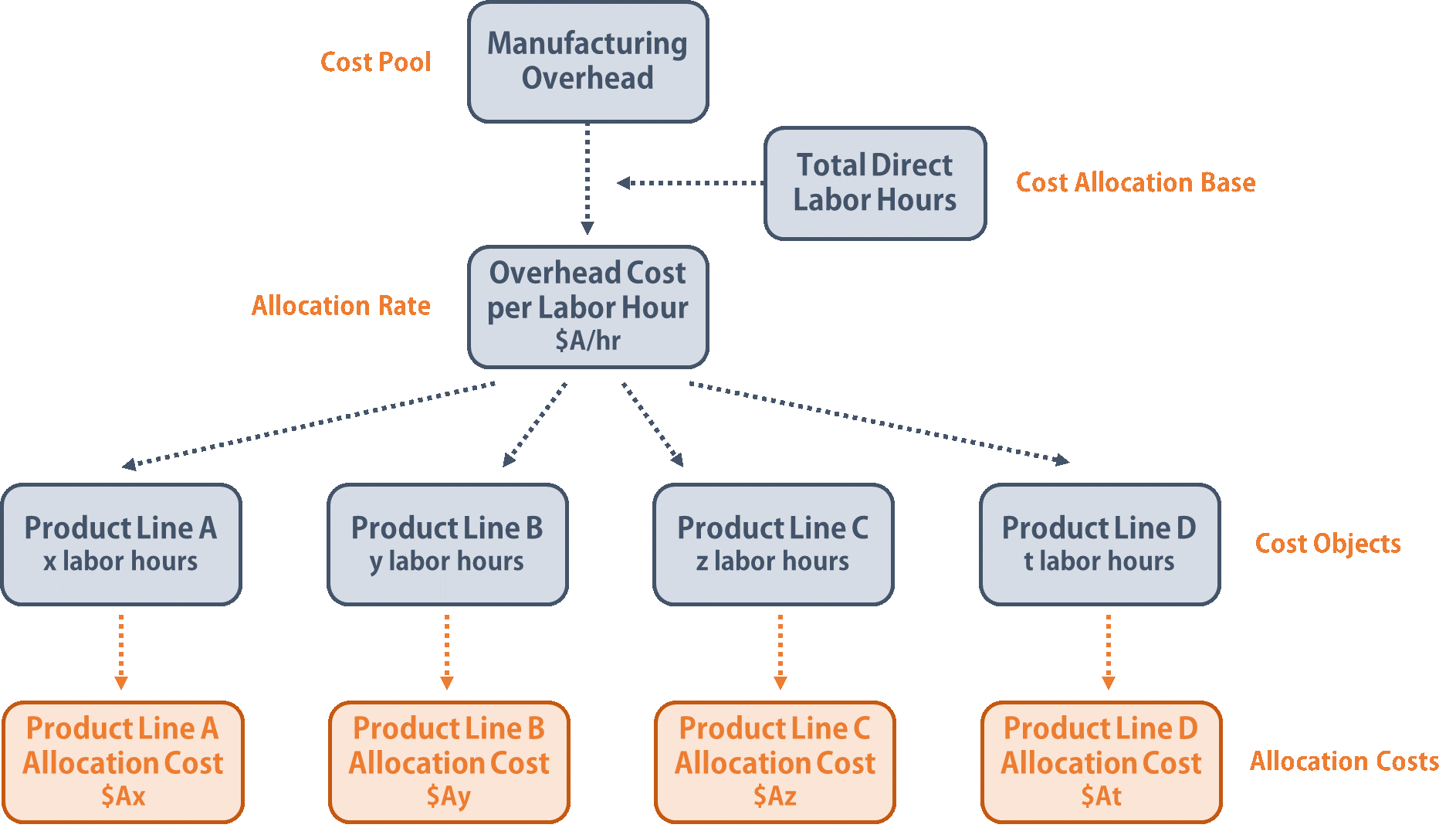

Examples of direct materials for each boat include the hull, engine, transmission, carpet, gauges, seats, windshield, and swim platform. Examples of indirect materials (part of manufacturing overhead) include glue, paint, and screws. Direct labor includes the production workers who assemble the boats and test them before they are shipped out. Indirect labor (part of manufacturing overhead) includes the production supervisors who oversee production for several different boats and product lines. However, if management wants to determine the profitability of a specific product or customer, it is necessary to allocate or assign nonmanufacturing costs to the products and/or customers outside of the financial statements.

These costs are represented during a period of time and are not calculated into the cost of good sold. Nonmanufacturing costs consist of selling expenses, including marketing and commission expenses and sales salaries and administration expenses, such as office salaries, depreciation and supplies. The purpose of addressing these costs differently as part of a total manufacturing cost formula is based on the fact that they are accounted for differently when structuring the income statement and balance sheet. Even though nonmanufacturing overhead costs are not product costs according to GAAP, these expenses (along with product costs and profit) must be covered by the selling prices of a company’s products. In other words, selling prices must be large enough to cover SG&A expenses, interest expense, manufacturing overhead, direct labor, direct materials, and profit. All manufacturing costs that are easily traceable to a product are classified as either direct materials or direct labor.

- But the tonnage of bricks produced every year is far higher than that of aluminum, so making bricks contributes more to climate costs overall than making aluminum.

- Once you identify the indirect costs, get detailed expense data for each of these overhead cost categories for a specific period, such as a month or a year.

- While manufacturing or production costs are the core costs for a manufacturing entity, the other costs are also just as important as they too affect overall profitability.

- These costs have two components—selling costs and general and administrative costs—which are described next.

- Direct labor costs include the wages and benefits paid to employees directly involved in the production process of goods or products.

Thus, management attention must be focused on both the core and the ancillary costs to control and manage them with a view to maximize profitability on long term basis. Selling Expenses – also called Selling and Distribution Expenses. Examples include advertising costs, salaries and commission of sales personnel, storage costs, shipping and delivery, and customer service.

Costs that remain constant regardless of the level of production or sales, such as rent and salaries. “Alternative materials are a really important research area,” Van Roijen said. These could include supplements to partly replace cement in concrete and biomass-based plastics.