It provides a quick overview of which accounts have credit and debit balances to ensure that the general ledger is balanced faster than combing through every page of the general ledger. When a business owner notices a sudden rise in expenses, they can investigate the general ledger to determine the cause of the increase. If there are accounting errors, an accountant can dig into the general ledger and fix them with an adjusting entry.

Can the general ledger help in business decision making?

This is often the role of a bookkeeper or other accounting staff,” said Cross. A general ledger works by categorizing each financial transaction that occurs in the business. For every transaction, there is a corresponding debit and credit entry, which ensures the books are always balanced. General ledger is very important in the company’s accounting system as it serves as the basis of the preparation of financial statements.

Understanding general ledger: Your financial foundation

A chart of accounts (also called a CoA) is like a financial filing system for businesses. Essentially, it’s the framework for all of the financial accounts, organizing and classifying transactions.It works hand-in-hand with the GL, which actually records the transactions. The general ledger is a foundational accounting document that contains a record of all your business’ activities. For each entry in your chart of accounts, it displays a sub-ledger documenting the details of every transaction affecting it, culminating in the account’s running balance. Some disadvantages of a general ledger include the cost and amount of time it takes to set up.

- Businesses will create separate categories for such transactions, which are known as accounts.

- The general journal is a great place to find out when accounting transactions happen.

- Needless to say, General Ledger is one of the primary books of entry and it forms the basis of your financial statements and helps you in evaluating the financial affairs of your firm.

- Accounts are usually listed in the general ledger with their account numbers and transaction information.

- These detailed entries tell you the who, the what, the when, the where, and the why—leaving no room for confusion, thus creating clearer transaction explanations.

- Having a general ledger may help the audit run smoothly, because you can easily verify information if various accounting items are classified and recorded accurately.

Does a general ledger use double-entry bookkeeping?

It can be very difficult to organize if you have a huge number of transactions in a given accounting period, which is where GL Codes can come handy. As you can more easily find transactions you are searching for in your general ledger if you have a code for every transaction. In this instance, a subsidiary ledger tax implications of converting an llc to a corporation records detailed information of the related control account. Accounts receivable is most commonly used as a general Ledger control account. Say, for instance, you were overcharged for an item you purchased, it then becomes challenging for you to identify this transaction if the ledger accounts are not prepared.

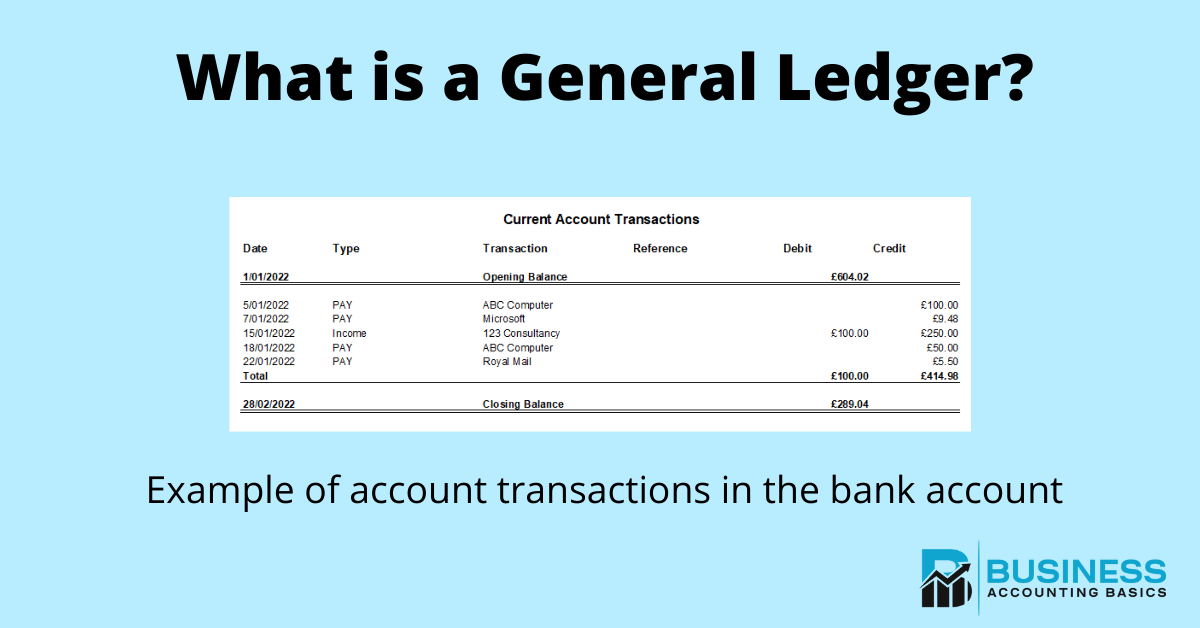

A good way to think of this is a history of all transactions within a business. The example shows the electricity expense account which is on page 21 of the ledger. The name of the account ‘Electricity Expense’ and its account code 640 are also shown in the heading. It’s available to download in Google Docs, Google Sheets, XLS, DOC, and PDF, making it easier to see your business finances at a glance. Liabilities are the amounts owed to individuals or outsiders, and are the financial obligations you’re bound to fulfill. These are the obligations that you have to fulfill the amounts you have borrowed and which have not yet been paid for.

Income Summary Meaning in Accounting (Helpful Overview)

The accountant would then increase the asset column by $1,000 and subtract $1,000 from accounts receivable. The equation remains in balance, as the equivalent increase and decrease affect one side—the asset side—of the accounting equation. The account details can then be posted to the cash subsidiary ledger for management to analyze before it gets posted to the general ledger for reporting purposes.

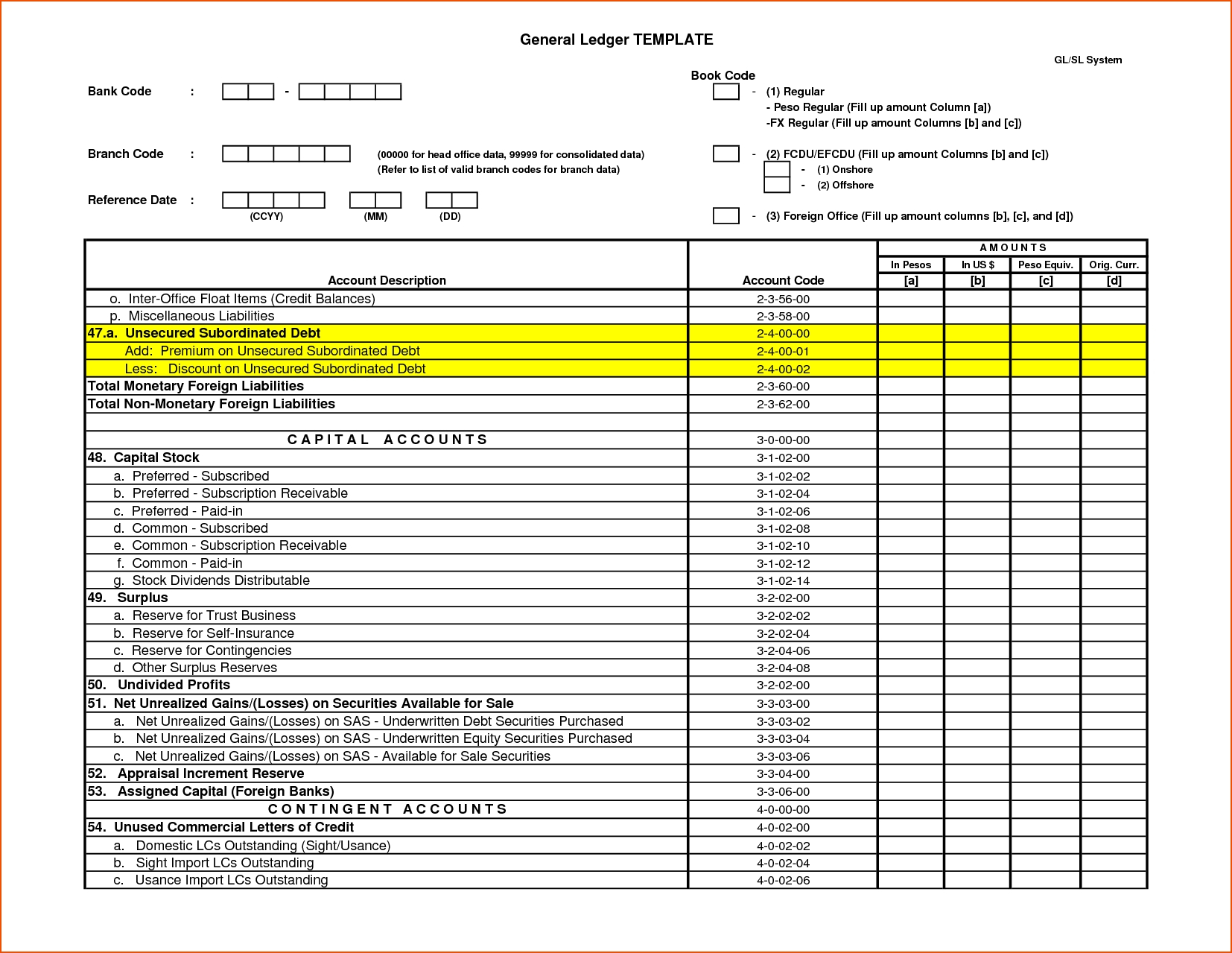

Since both sets of entries derive from the same source the use of a control account allows the carrying out of a GL reconciliation. The ledger contains accounts for all items listed in the accounting equation, i.e. assets, liabilities and equity. Of course equity includes capital, revenue, expenses, gains, losses, drawings, and retained earnings, so the ledger must at least include GL account codes for each of these groups. To reconcile your GL at the end of each fiscal period, you must generate a trial balance by totaling all of the debit and credit accounts and then checking to verify that the debits are equal to the credits. If these are not equal, then the accountant will check for errors in the journals and accounts. Options to include on your GL chart of accounts are assets, liabilities, revenues, equities, and expenses, along with other income and expenses, if relevant.

All transaction data comes to the general journal and makes its way to the general ledger. Sub-ledgers are particularly helpful for businesses with a high sales volume because you can segment your financial transactions into digestible categories, making managing your financial data easier. General ledger accounts are the categories that your general ledger is organized by. It’s also called sub-ledgers, which are like the notebooks you use to record your transactions as they occur. All of those transactions are then transferred into your “master notebook,” which—you guessed it—is your general ledger.Here are a few examples of the types of general ledger accounts. As a business owner, you can use small business software and bookkeeping professionals to minimize your accounting responsibilities.

For instance, a retailer might have an account for promotional inventory not for sale. Instead, a manufacturer would probably have raw materials inventory, work in process inventory, and finished inventory accounts. It isn’t uncommon for manufacturers to create specific accounts for each custom job done during the year.

Your bookkeeper needs to set up your accounting books using the most suitable sub-ledgers for you. Equity accounts show details in ownership interest of your business’s shareholders. Common stock, retained earnings, and additional paid-in capital are just three of the typical types of equity accounts in a GL. The general ledger is one of the cornerstones of the double-entry accounting system.